Are changes in regulation and resolution regimes sufficient to reduce the value of implicit bank debt guarantees? Or are actual losses for bank creditors needed?

Banks continue to benefit from implicit guarantees (Schich, 2018). Market participants’ expectations that public authorities might bail out the creditors of banks considered too big or important for another reason to be allowed to fail, give rise to such guarantee. Such perceptions imply that banks’ access to the financial safety net guarantees is not adequately priced, as these guarantees are not charged for. These perceptions are economically costly (e.g. Denk et al., 2015).

Thus, public authorities have set out to limit them. As aptly summarized by Schäfer et. al. (2016), however, actions speak louder than words in this regard. Mere regulatory and resolution regime changes are not very effective. By contrast, bailing in creditors of insolvent banks is effective in reducing such perceptions (Kim and Schich, 2012).

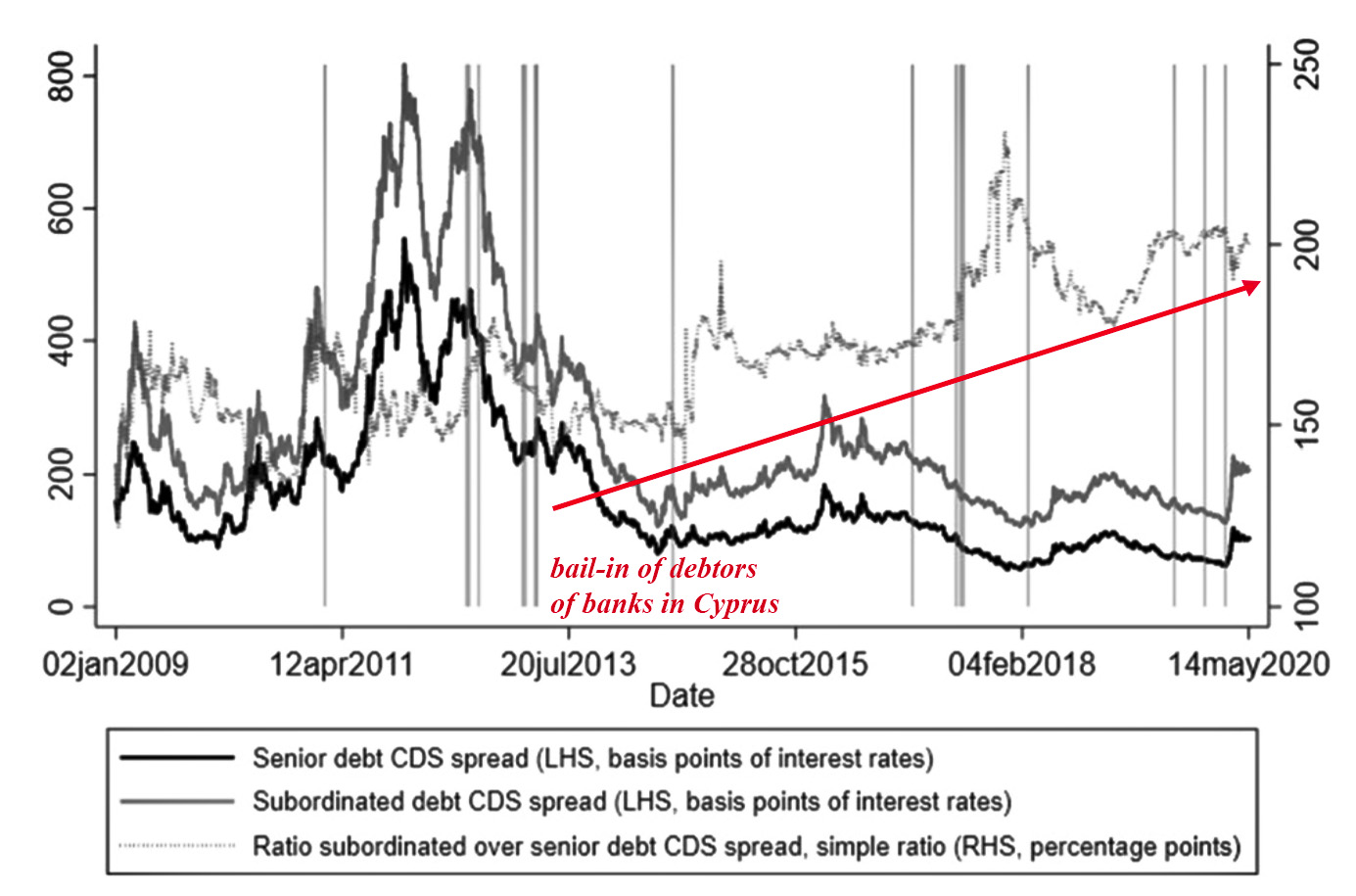

The costs of protection of subordinated debt, as compared to senior debt, are higher. They have also increased over time. Junior, as opposed to senior, creditors of banks are perceived as more at risk of being bailed in than they were previously. The difference in bail-in perceptions between the two classes of debt have become more pronounced. This is shown by the red arrow in the chart below.

A study with colleagues from the European Commission Joint Research Centre in Ispra confirms that progress has been made following the 2011/12 European financial market turmoil. The value of implicit bank debt guarantees for some types of debt has declined noticeably. However, the study also suggests that when the bail-in of creditors of a struggling bank does not occur (a sort of “no action”), the value of implicit guarantees for senior debt increases. Actions, or the lack of them, speak louder than words. As a result, the perception that senior as compared to junior bank debt is particularly protected became further entrenched.