Do public venture loans help overcome the diagnosed financing gap for SMEs in Europe and help them to grow?

The preferred policy tool to achieve more desirable credit allocations consists of financial sector guarantees, e.g. for bank lending or securitisations of claims. Alternatives exist, however. A recent example is direct public venture lending to SMEs and somewhat larger firms. Venture debt consists of long-term loans with repayment obligations linked to company performance. It complements venture capital and funds scale-up of enterprises. The European market for venture debt is not yet well developed and considerably smaller than the US market, but growing. The growth reflects the activity of the European Investment Bank (EIB), a public bank.

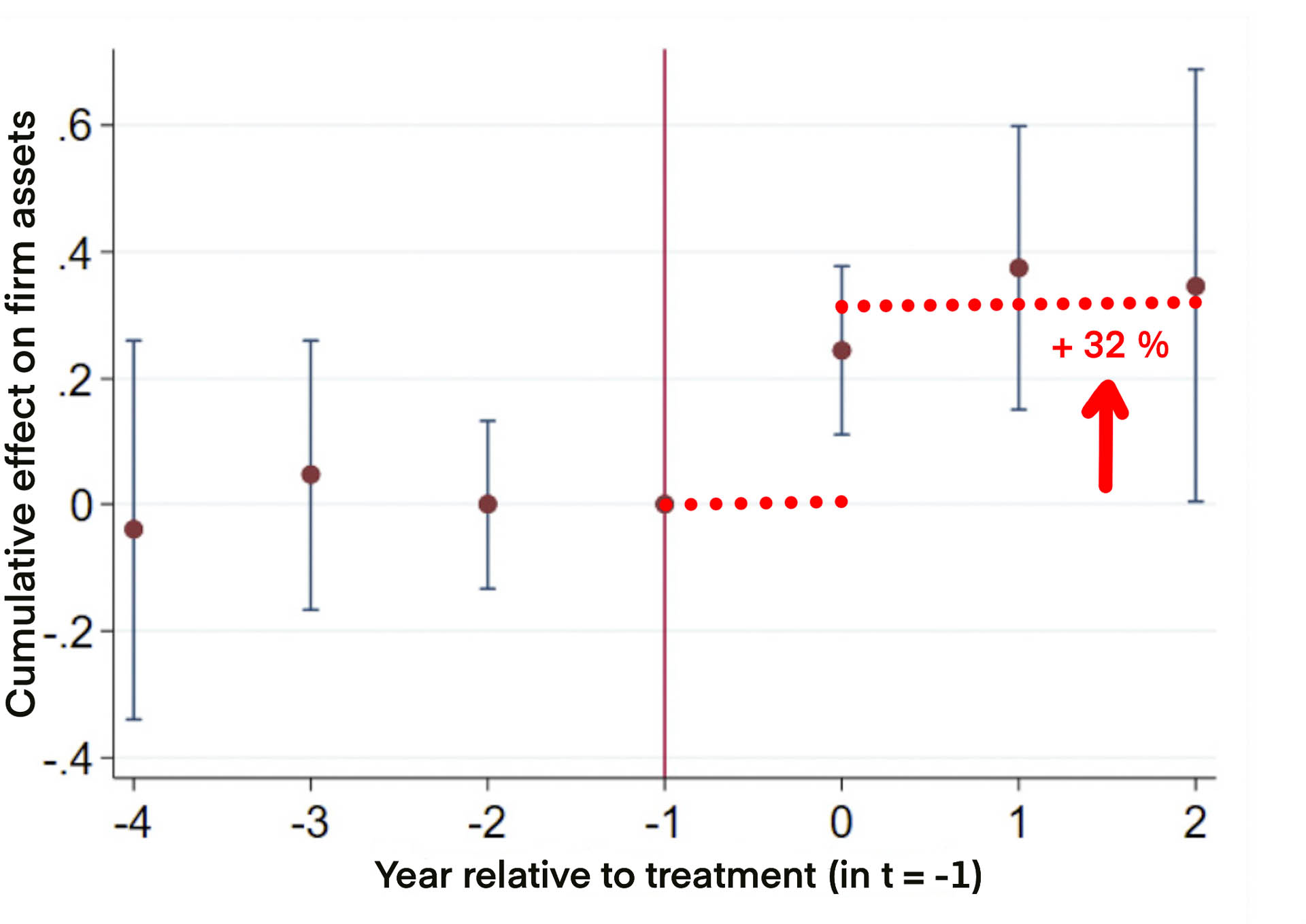

A 2022 study of EIB venture debt activities since 2015 shows that beneficiaries, relative to comparable peers that do not receive such loans, report significantly larger asset growth and productivity. They also report higher additional debt, which suggests crowding-in of other financiers by signaling that the beneficiary is promising and soundly managed. The graph shows the cumulative effect on total assets relative to the year prior to loan signature and to peers. Venture debt beneficiaries report about 30% more assets, on average over the three subsequent years.

The signaling effects of public intervention are likely particularly relevant in less-developed financial market segments, such as the European venture debt market. To what extent results translate to more developed financial market segments, and public support for SMEs more generally, is not clear. Rigorous impact assessment of the various long-standing financial support programmes is still not standard practise internationally.