Stablecoins are not robust anchors. In volatile financial markets, safety and stability are desirable. Hence, investors seeking refuge from economic uncertainties often gravitate towards safe-haven assets. Safe haven assets maintain or increase their value during market turmoil by offering temporary protection. Several empirical studies focus on safe assets. Yet another concept is that of an anchor asset. Such an asset consistently provides (relative) stability, thus serving as a reliable reference point regardless of market conditions. Stablecoins are not such assets. .

Safe haven versus anchor assets

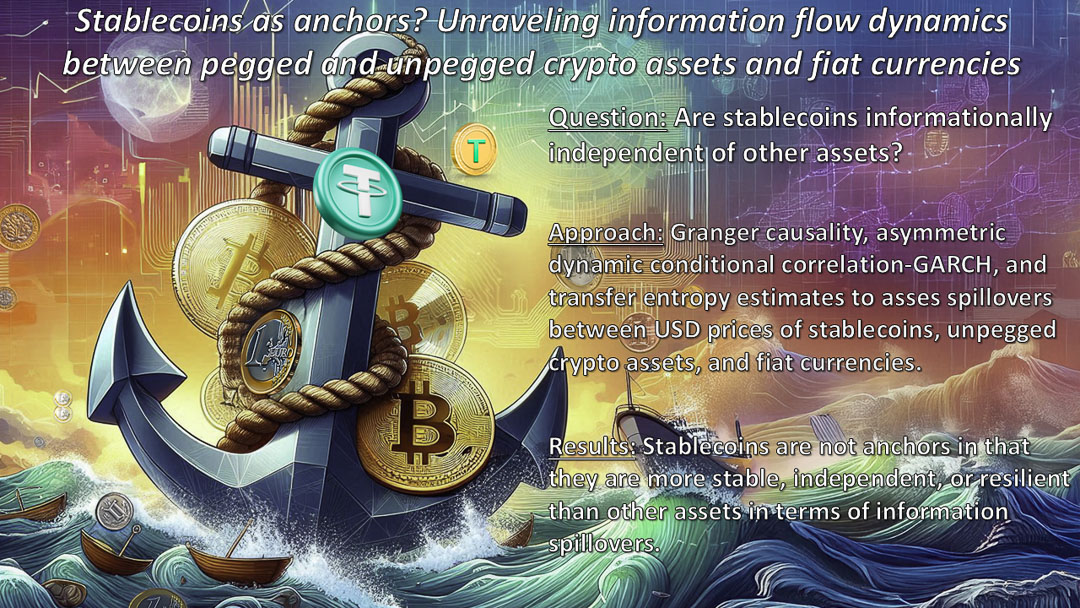

Images can be used to elucidate the nuances between the two concepts. An anchor asset can be analogised to the function of an anchor in a vessel. As a vessel’s anchor provides stability and prevents drifting in fluctuating tides and currents, an anchor asset aims to maintain a consistent value and serves as a reference point in volatile financial market conditions. Conversely, a safe haven asset can be likened to a harbor in which a vessel is sheltered during inclement weather. It does not necessarily prevent adverse conditions but offers protection to vessels seeking refuge from turbulent waters.

This analogy has implications for the behavior of an anchor asset in the three dimensions of stability, independence, and resilience. i) A vessel with an anchor is generally more stable than other vessels in both calm and turbulent waters. ii) The movement of such a vessel is not much influenced by the movement of the surrounding vessels. iii) Furthermore, its motion is less affected, compared with other vessels, by the turbulence caused by inclement weather.

As background, Claessens et al. (2017) used a similar image to compare the performance of different financial intermediaries, suggesting that bank capital acts as an anchor. It stabilizes credit provision amounts and conditions and thus mitigates the adverse effects of credit shocks on firms experiencing such shocks. Higher capital levels facilitate the continuation or lending in volumes and conditions as before an adverse event. Better capitalized banks provide higher stability in intermediation. Incidentally, this observation also testifies to the crucial role of minimum capital requirements in bank regulation.

A framework to define an anchor asset

A new conceptual framework draws on this metaphor to assess financial assets in terms of mutual information flows. It considers three dimensions: (i) stability, (ii) independence, and (iii) resilience, to check empirically whether an asset might be a robust anchor.

With regard to (i), both the anchor and safe-haven functions are fundamentally rooted in the asset’s capacity to maintain a stable value towards some numeraire. The US dollar serves as a prime example for the latter, given its preeminent status as the world’s most significant reserve asset. Thus, for an asset to function as an anchor, it must exhibit stability relative to the USD. This relative stability must hold at all times. By contrast, a safe haven shines during periods of market turbulence. In fact, during such periods, when other assets are under downward valuation pressure, a safe haven asset might even gain value.

With regard to (ii), both functions demand a certain degree of independence from other assets. Both functions imply that the asset retains its value and utility even when other financial instruments or currencies experience volatility. A safe haven asset may even increase its value as a result of the trouble facing other assets.

Regarding (iii), the resilience aspect is pertinent to both functions, albeit with slightly different emphasis. The anchor function requires consistent stability over extended periods, ensuring that the asset serves as a reliable reference point for other currencies and financial instruments. By contrast, the safe-haven function becomes especially critical during specific episodes of market stress. During such periods, investors seeking refuge amidst widespread uncertainty and volatility tend to push up the prices of safe-haven assets.

New empirical evidence suggests that stablecoins are not robust anchors

A review of the empirical literature on the interlinkages between conventional financial and crypto assets highlights that the safe-haven concept focuses primarily on performance during periods of market turbulence. For instance, stablecoins function as crypto-safe havens against Bitcoin and traditional equity market volatility, preserving the overall portfolio wealth through their own stability during market downturns.

By contrast, the concept of an anchor asset emphasizes consistent stability over time. Anchor assets serve as a constant reference point for an investment portfolio. A recent study (Stablecoins as Anchors? Unraveling information flow dynamics between pegged and unpegged crypto assets and fiat currencies) considers a variety of empirical tests — such as Granger causality, asymmetric dynamic conditional correlation-GARCH, and transfer entropy estimates — to assess spillovers between the USD prices of stablecoins, unpegged crypto assets, and fiat currencies. Importantly, it only considers major stablecoins that have survived and increased in market capitalization during stress episodes as opposed to those that have collapsed, such as e.g. the TerraUSD stablecoin.

The study shows (see also the graphical abstract below) that stablecoins pegged to the US dollar perform better than unpegged crypto assets in terms of stability. However, they do not perform better than fiat currencies do. Additionally, stablecoins do not perform better than the other two asset classes in terms of independence or resilience. Thus, stablecoins are not better anchors than unpegged crypto assets or fiat currencies (other than the US dollar). Another question is, however, what asset might be a robust anchor when the USD is not considered the numeraire.