Will fintech make banks less “special”?

The short answer is no. Banks manage two sets of cash flows – deposits and loans – and provide two key services – liquidity provision and maturity transformation. Banks provide these services in bundled form. As a result of their activities, they are subject to potential “runs”. Thus, banks face comprehensive oversight. This regulatory and supervisory constraint is part of banks’ access to the publicly supported financial safety, which includes financial sector guarantees such as deposit insurance. It is this access that makes banks “special”.

Unbundling of financial services

Fintech implies an unbundling of the provision of the financial services provided in bundled form by banks, making the delivery of each individual service more convenient and cheaper. Traditional banks respond by buying up or collaborating with fintech entities to enhance their own efficiency. Nonetheless, they will continue to face competitive threats as regards specific types of services. As a result, bank profits in these specific areas will continue to face pressures.

Fintech’s effect is most acute in lending, payments, and customer experience. Examples include the following. Peer-to-peer (P2P) and balance sheet lending models directly compete with banks in lending. Digital wallets and instant payment platforms bypass traditional payment rails. They reduce banks’ fee income from card processing and wire transfers. Fintech provides highly personalised, convenient and often cheaper financial services. It democatrises access to processes that were once exclusive to banks.

The longer answer

Nonetheless, central banks continue to rely on the bank lending channel for their own steering of financing conditions for firms and households. In the current fractional reserve banking system, banks can lend out a significant portion of the deposits they receive, thereby expanding the overall money supply. Central banks currently rely mainly on banks to transmit monetary policy impulses. That said, to the extent that central banks issue their own central bank digital currencies (CBDC) directly to retail customers, things will change fundamentally. As a result, the role of banks will evolve as well as the extent of privilege that banks benefit from. Thus, the longer answer to the above question is more nuanced.

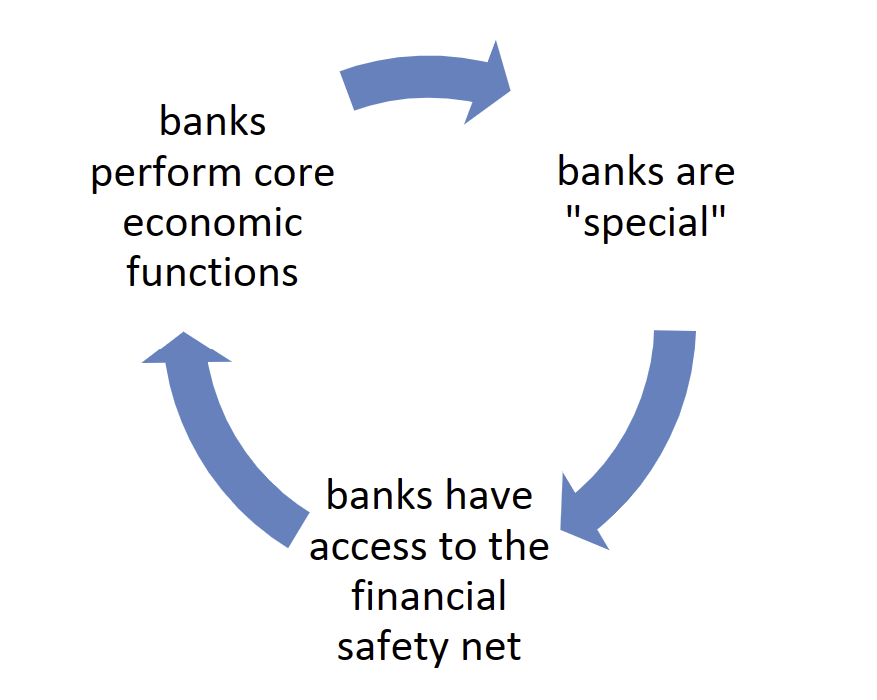

Research by economists, formerly OECD, (here and here) suggests that banks have long been regarded as “special”. Private banks occupy a key role in the current financial and monetary system. In exchange, they are given access to the publicly supported financial safety net. This privileged role is not set in stone, however. In fact, an element of circularity exists. This issue is illustrated in the chart below. On the one hand, identifying banks as “special” qualifies them for access to the financial safety net. On the other, for banks to effectively perform some of their core characteristic economic functions — liquidity provision combined with maturity transformation — requires them to have access to the provisions financial safety net. That access, in turn, makes them “special”. Other entities aim to and might succeed in obtaining similar access.