US monetary credibility and evolving crypto flows

The current US executive’s attack on the top officials of the Federal Reserve is a sharp affront to decades of hard-won wisdom in central banking—wisdom painstakingly gained through policy errors and inflationary crises, and also credited with delivering stable and...

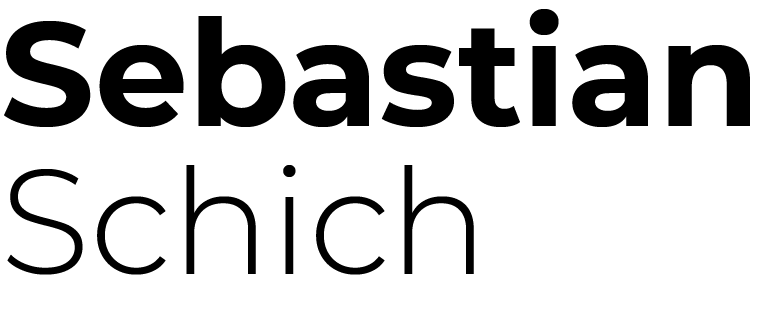

Stablecoins are not robust anchors

Stablecoins are not robust anchors. In volatile financial markets, safety and stability are desirable. Hence, investors seeking refuge from economic uncertainties often gravitate towards safe-haven assets. Safe haven assets maintain or increase their value during...

Embracing individual morality in artificial intelligence

Embracing individual morality in generative artificial intelligence The release of ChatGPT by OpenAI in late 2022 may well have been a tipping point for artificial intelligence. Since then, generative artificial intelligence (GenAI) models have moved beyond generating...

Visualising sound waves

The universe is constantly in motion due to vibratory waves, which have been called “music of the universe”. Works by Ximenes visualizes some of these patterns.

Extraordinary bank levies as a charge for extraordinary privileges?

Banks benefit from an extraordinary privilege, which is that governments act as guarantors of last resort for banks’ financial obligations to avoid systemic financial crises. Should banks pay a special tax in return?

Public financial sector guarantees need to be carefully priced

Financial sector guarantees are a key public policy tool All financial claims are risky. Against this background, governments have traditionally provided support for guarantees of financial claims, provided they of public policy interest. This choice is based on the...

ChatGPT announcement and Google job search trends

The ChatGPT announcement triggered searches for jobs in functions exploiting artificial intelligence (AI). While it also heighted job security concerns, Google job search trends suggest that people, rather than sitting idle, react by exploring associated new...

Why banks are “special” and does Fintech change that?

Will fintech make banks less “special”? The short answer is no. Banks manage two sets of cash flows – deposits and loans – and provide two key services – liquidity provision and maturity transformation. Banks provide these services in bundled form. As a result of...

Do public venture loans help SMEs grow?

Do public venture loans help overcome the diagnosed financing gap for SMEs in Europe and help them to grow? The preferred policy tool to achieve more desirable credit allocations consists of financial sector guarantees, e.g. for bank lending or securitisations of...

Ending too-big-to-fail: Actions versus words

Are changes in regulation and resolution regimes sufficient to reduce the value of implicit bank debt guarantees? Or are actual losses for bank creditors needed? Banks continue to benefit from implicit guarantees (Schich, 2018). Market participants’ expectations that...